Al Zour Refinery Marks Structural Change To Kuwait’s Crude Exports

Since Saudi Arabia implemented its additional 1 million b/d voluntary production cut on top of existing OPEC+ cuts in July, the evidence of a marked tightening of global medium sour crude oil markets has strengthened considerably.

This is reflected in regional crude oil pricing, with Adnoc pricing its 34° API Upper Zakum export grade at parity with the 40° API Murban for September. Similarly, Saudi Aramco has priced its September-loading 29-32° API Arab Medium at a $0.80/B discount to its 36-40° API Extra Light to Asia, marking the largest such discount since June 2020. Such pricing is indicative of a light/medium crude imbalance, with refineries struggling to secure access to traditionally lower-priced medium sour barrels.

Fig. 1: ADNOC prices Upper Zakum at parity with Murban (Sept-loading) for first time since Mar 21

Source: REA

Fig. 2: Saudi Arab Medium vs XLT OSP to Asia. Arab Medium priced at highest premium to Arab Light since Jun 20

Source: REA

The scale of these market disruptions has largely hidden the impact of a more structural change to Middle East medium-sour production levels – namely the impact of Kuwait’s Al Zour refinery on the emirate’s crude oil exports. With CDU capacity of 615,000 b/d, Al Zour is the region’s single largest refinery, and as operations ramp up it is consuming an increasingly large volume of Kuwaiti crude oil feedstock. All three CDUs are now operational, and full capacity is planned to be reached by end-September.

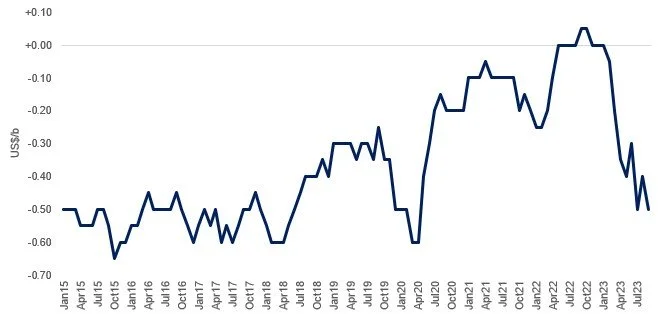

The impact has already been significant, with Kuwaiti crude oil exports (excluding Neutral Zone) falling to 1.36 million b/d in July according to Kpler. This is down more than 500,000 b/d from 1.86 million b/d in January and is the lowest figure since September 2009. We expect exports to decline further once Al Zour is fully operational, although market sources indicate that KPC will not run its refining fleet at maximum capacity this year in order to ensure that it meets 2023 term export commitments.

Fig. 3: Kuwait crude exports by destination (kb/d)

Source: REA, Kpler

We note that the volume of crude oil freely available for buyers is significantly lower than the headline crude export figure, with KPC routinely delivering nearly 200,000 b/d to the Nghi Son refinery in Vietnam, where KPC has a 35% stake and is the sole supplier of crude oil feedstock. Once Al Zour is 100% operational, the amount of crude oil available for third party buyers could drop to barely 1 million b/d.

This figure will fall even further once the 230,000 b/d OQ8 refinery at Duqm in Oman begins commercial operations, potentially as soon as the end of the year. KPC has a 50% stake in the refinery and is committed to providing at least half of the refinery’s feedstock.

Kuwaiti crude oil exports will remain at historically low levels for as long as the current OPEC+ production cuts remain in force. The current production quotas and voluntary cuts are scheduled to last until end-2024, although we expect restrictions to be eased in the event of a significant tightening of global markets. But even then, exports will remain below pre-2023 levels due to Al Zour’s operations.

Despite the scale of the drop-off in Kuwait crude exports, market sources say there have been no instance of buyers having supplies cut. So far, the only major market to experience a significant drop in supplies of Kuwaiti crude has been China, where buyers have instead been reducing their purchases of crude oil from Kuwait and other regional producers as they have increased imports from Russia and to a lesser extent Iran.

In particular, Kpler data shows that China’s Sinopec and Rongsheng-subsidiary Zhejiang Petroleum (ZPC) have reduced imports of Kuwaiti crude in recent months. Under the terms of Saudi Aramco’s recently finalized purchase of a 10% stake in Rongsheng, Saudi Aramco is to supply 480,000 b/d of Arabian crude to ZPC’s 800,000 b/d complex. Although Saudi Aramco is already ZPC’s largest supplier this will reduce ZPC purchases from elsewhere.

Meanwhile key buyers such as South Korea’s SK Energy and Japan’s Eneos continue to receive full nominations.

It is also notable that despite the historically low availability of Kuwaiti crude exports, KPC has adopted a much less aggressive pricing strategy than Saudi Aramco. As a result, Kuwait’s primary 31° API KEB export grade is priced at a $0.50 discount to the comparable Arab Medium for September loadings to Asian destinations.

Fig. 4: Kuwait Export Blend OSP v Saudi Arab Medium

Source: REA

Kuwaiti crude imports will be structurally lower than late-2022 levels even after OPEC+ cuts are finalized due to its expanded refining sector. How close they come to returning to 2022’s average crude oil export figure of 1.79 million b/d will depend in large part on whether KPC is able to succeed in adding 300,000 b/d to its production capacity by end-2024. Kuwait has a track record of falling short on capacity expansion plans, but there are positive indicators that KPC’s new leadership is at least making progress.

With Q4 approaching, 2024 term contract finalization is just around the corner and KPC will have to assess just how much crude oil availability it will have for next year. Having painstakingly built up relations with its buyers over the years, KPC will not want to alienate valued partners through cutting them off, but it will also have less crude oil to market than at any time over the past decade. If any term deals are to be permitted to lapse, the likeliest candidates will be Chinese refiners which are already shifting to new baseloads.